Posting the very 1st article on my blog...

Like most of you guys am also a technical person (formally),but nothing much interests me from my own field. What convinces me to write this piece of information is the addiction that I have got to this Financial Jungle-Stock trading. In my opinion it is one of the best thing one (not 1 but any1) can do without much of effective or prior knowledge of this field and also anytime, anywhere with the use of our laptops or the very friendly mobiles.

Thanks Sharekhan, because of you guys am tempted to write here for others. I am not promoting this brokerage house but their very cordial Relationship Managers and user friendly software (Trade Tiger) are worth mentioning here. I started this when I was pursuing some course with a very reputed institute as a part time hobby and to take a feel of this financial jargon. I never knew someday I would feel a sort of addiction to it and would start seeing good career prospects in the field of capital investments.

Why trade OR Why only trade ???

The easiest way to make money is Stock trading. Market means a movement in prices and price movement is a simple game of "Demand & Supply". There is money in the rising (long) as well as in the falling (short) market. What all you need is a mobile (better if you have a laptop), a bank account with a cheque book, a PAN card and an identity proof (better if u have an aadhar card).

Market = Price Movement

Price Movement = Demand & Supply

Now I come to why only trade ???

A person who has just started his career wouldn't think of investing in a property (you guys must be aware that real estate investments are always big in amount and possess certain other risks with them), can think of buying gold for investment purpose but I find this investment obsolete (taking gold in physical form because of the deductions made at the time when you want to convert it into liquid cash). The only good option that remains open is Equity investment or Mutual Fund investment through SIPs (Systematic Investment Plan). MFs also trade in the same Equity markets where we can trade directly without making them intermediaries in the profit-making process. I call equity trading simple and easy because you can start with any amount of your choice (better if it is anything above INR 1000).

When trade ???

Any hour of the day (Monday to Friday) between 9:15AM-3:30PM. The best part is weekends off. This is the time when the 2 popular exchanges where we trade are open for traders. Any trader can trade for some 3-5% return in a single day (average) and an investor can trade for some 7-10% return on his investments on a monthly basis (average). This field is highly subsidized. Brokerage houses allow some 5-10 times leverage to intra-day traders and some 2-4 times to investors (for a maximum period of 5 days)

What to trade ???

You have the option to trade a variety of things-

1) Stocks

2) Currency

3) Agro-commodities

4) Comodities (Bullions,oil,gas,etc)

But we will confine ourselves to Stocks trading only. You can trade any Indian Stock you want provided it is listed on either BSE or NSE. The scripts are categorized as according to their standing in the market. Better scripts attract higher leverages from brokers and there may be some scripts for which you should have the full amount in your trading account. I will discuss the brokerage and other aspects in the coming articles. But let us very quickly know who are running the Indian market-

1) FIIs - The Big Big Boys

2) Professionals or Investment Bankers - The Bigger Boys (they trade for MFs)

3) RBIs monetary policy

4) Monthly expiry of contracts-The Most Volatile Day of the Month

5) Federal Reserve Bank (Central Bank of America) conclusions.

6) Any news in a particular stock.

7) Quarterly Results of Companies.

8) Dollar-Rupee relation

9) US markets (opening bell) & European markets (market movement after 2PM)

10) International and National events

The big list of the controllers seem scaring but they are all inter-related to each other in some or the other way. I will talk about this relationship later. To begin, trade any XYZ stock and try to consolidate your profits.

No one, not even the big boys in the market have a perfect trading strategy. They trade, fail or succeed, learn from their mistakes and also from mistakes of others and trade better the next time. Nobody in the world knows where the market is heading to and when it will crash. Everybody just speculates. Few hit it correct and so they become famous to give advice or tips on the TV channels. But I tell you I have seen most of them failing and not even hitting the targets equivalent to a decent success rate.

It is very truly said by India's Warren Buffet Mr. Rakesh Jhunjhunwala, "You can't make money from borrowed tips". It has to be your choice, your understanding of the buying, selling and stop loss levels. All these 3 vary from trader to trader. It is that everybody's satisfaction level is different (I may end up with 2-3 bottles of beer followed by heavy dinner but my friend Repzzz may want more as "Yeh dil maange more") !!!

How much to trade ???

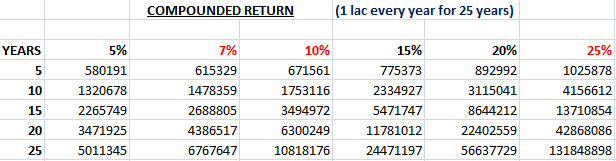

The very simple answer to this question is Trade as much as you can but remember that you don't take undue advantage of the leverage that your broker is providing you and you don't land yourself in trouble. The best way to make sure shot money is to utilize the minimum leverage for intra-day trades and stick to your capital for investments. Investment should be on a SIP basis for better and enhanced returns. I will talk about what I meant by enhanced returns here in my next article and show it to you with some rough calculations that I have done for myself. This is the beginning of a Bull market from May 16, 2014.

Don't hesitate to trade but then don do over-trading too as excess of anything is harmful for health !!!

There is a lot more to the story of financial markets because the process of money-making is limitless.....

See u guys...In the next article we will see how easily money can be made by the process that we have just started !!!